Discover how to identify high-return investments in commercial property in Portugal. Learn key factors — location, tenant quality, lease terms, and market demand — backed by expert insights from Roca Estate to maximize your ROI in real estate.

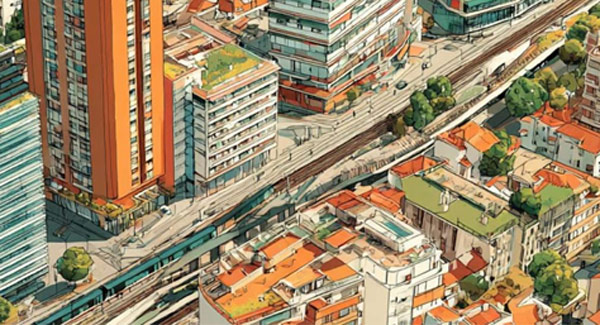

High-return investments in commercial property in Portugal are attracting increasing interest from global investors seeking both strong yields and long-term capital growth. Supported by economic stability, a resilient tourism sector, and favorable government policies, Portugal'sreal estate investment landscape offers a compelling mix of profitability and security. The country's transparent legal framework, improving infrastructure, and integration within the EU further strengthen its position as a safe yet dynamic market for commercial asset acquisition.

However, identifying truly profitable property investments requires more than simply following market trends. Investors need a systematic approach based on measurable criteria and risk assessment to ensure consistent performance across economic cycles. This article examines four critical factors — strategic location, tenant quality, lease terms, and market demand — that determine the success of commercial real estate returns in Portugal, providing a practical framework for informed decision-making.

Why Focus on High-Return Investments?

In the context of commercial property in Portugal, 'high-return' refers to assets that combine strong ROI in real estate with long-term value preservation. Typically, this means properties delivering:

- Attractive rental yields — Prime Lisbon and Porto assets often generate 5–8% annually.

- Capital appreciation potential — Especially in areas undergoing urban regeneration or infrastructure upgrades.

- Sustainable cash flow — Backed by stable, long-term tenants with low vacancy risk.

For investors, focusing on high-yield commercial property is not about chasing the highest possible short-term gain — it is about building a portfolio that consistently outperforms inflation, withstands market volatility, and maximizes total returns over the asset's life cycle.

Portugal is currently positioned to deliver these results due to several structural and macroeconomic advantages:

Factor | Impact on Returns | Example |

GDP Growth | Encourages business expansion, driving demand for office, retail, and logistics space | Projected GDP growth of 2–2.5% over the next three years |

Tourism Strength | Increases demand for retail, hospitality, and mixed-use developments | Algarve hotels averaging >75% occupancy in peak seasons |

Foreign Investment Incentives | Attracts global capital through favorable residency and tax programs | Golden Visa and Non-Habitual Resident (NHR) schemes |

Infrastructure Development | Enhances property accessibility and market appeal | New metro lines in Lisbon and Porto |

These fundamentals create an environment where profitable property investments are not only possible but sustainable. For investors aiming to enter or expand within the Portuguese property market, the priority should be assets backed by proven demand drivers and supported by strong economic indicators.

Strategic Location

In property investment Portugal, location remains the most decisive factor influencing rental yields, occupancy rates, and long-term capital appreciation. Prime locations command higher rents, maintain liquidity in all market conditions, and tend to recover faster after economic downturns. The ability to identify and secure assets in areas with sustained demand is central to achieving high-return investments.

When assessing commercial property in Portugal, investors should evaluate:

- Business Hubs: Lisbon's Central Business District (Avenida da Liberdade, Amoreiras) offers premium office space with strong corporate demand.

- Retail Arteries: Porto's Rua de Santa Catarina and Lisbon's Chiado area attract high-footfall retail, benefiting from both residents and tourists.

- Tourism Hotspots: The Algarve coastline and Madeira's Funchal provide robust hospitality returns due to consistent seasonal and off-season demand.

- Accessibility: Proximity to airports, major highways, metro lines, and port facilities significantly enhances tenant appeal and operational efficiency.

Selecting assets in locations backed by stable demand drivers not only increases immediate rental income but also supports sustained commercial real estate returns over the long term.

Tenant Quality

In profitable property investments, tenant quality is a critical determinant of both income stability and risk management. A high-yield commercial property occupied by financially secure, reputable tenants offers predictable rental income, reduces vacancy risk, and preserves asset value in the long term. Conversely, unreliable tenants can erode yields through late payments, premature lease terminations, or costly disputes.

When conducting a tenant quality assessment, investors should consider:

- Financial Strength: Review audited financial statements, credit ratings, and liquidity ratios to confirm the tenant's ability to meet obligations.

- Business Reputation: Established brands and market leaders enhance property prestige and attract complementary tenants.

- Sector Stability: Tenants in resilient sectors such as logistics, healthcare, and technology often maintain operations even during economic downturns.

- Lease Compliance History: A track record of honoring lease agreements without disputes signals lower management risk.

Prioritizing financially sound, well-established tenants not only safeguards immediate commercial real estate returns but also strengthens the long-term investment profile of the asset.

Lease Terms and Stability

For investors in commercial property in Portugal, the structure and stability of lease agreements play a decisive role in securing predictable cash flow and mitigating operational risk. Well-structured leases provide income visibility, reduce vacancy turnover, and protect commercial real estate returns from inflation and market fluctuations.

Key considerations for maximizing stability include:

- Long-Term Leases (5–10 years): These agreements reduce re-letting costs, minimize downtime, and provide consistent revenue streams.

- Triple-Net Leases (NNN): Tenants assume responsibility for property taxes, insurance, and maintenance, increasing the investor's net yield.

- Index-Linked Rent Agreements: Adjusting rent in line with inflation safeguards real returns and maintains purchasing power over time.

- Early Termination Clauses: Well-defined terms limit unexpected vacancy risk and allow for compensation in case of premature lease exits.

A balanced approach is essential—excessive rigidity can deter tenants, while too much flexibility can undermine income stability. The optimal lease structure aligns investor objectives with market realities, ensuring sustainable, profitable property investments.

Market Demand and Trends

A thorough understanding of market demand is essential for identifying high-return investments in the Portuguese property market. Demand levels influence rental pricing, occupancy stability, and future appreciation potential. Sector-specific trends also determine which asset classes are positioned for sustainable growth.

Key demand drivers include population growth in urban centers, the expansion of tourism, and the rapid development of e-commerce logistics. Investors who align their portfolios with these dynamics can achieve higher and more resilient commercial real estate returns.

Current demand trends in Portugal's commercial sectors:

- Retail & Hospitality: Driven by strong domestic consumption and international tourism flows.

- Logistics & Warehousing: Boosted by e-commerce growth and nearshoring strategies.

- Mixed-Use Developments: Increasingly popular in urban regeneration projects, offering diversified income streams.

- Specialized Sectors: Healthcare facilities, student housing, and co-working spaces are benefiting from shifting demographics and work patterns.

Sector | Demand Outlook | Key Locations | Investment Considerations |

Retail | High | Lisbon (Chiado, Baixa), Porto (Rua de Santa Catarina) | Footfall consistency, brand mix, and lease length |

Hospitality | Very High | Algarve, Madeira, Lisbon | Seasonality management, operator strength |

Logistics | Growing | Lisbon outskirts, Leixões port area | Proximity to transport hubs, ceiling height, and loading capacity |

Mixed-Use | Moderate-High | Lisbon, Porto | Integration of residential, retail, and office components |

Healthcare | Stable-Growing | Lisbon, Porto, Braga | Demographic trends, operator reputation |

Monitoring macroeconomic data, tourism indicators, and infrastructure developments ensures that investors position themselves in sectors with the strongest long-term fundamentals for profitable property investments.

Conclusion

Achieving consistent results in high-return investments within the Portuguese property market requires a disciplined approach grounded in market data and risk assessment. Strategic location, tenant quality, lease terms, and sector demand are the four pillars that determine the performance and resilience of profitable property investments. Evaluating each factor with measurable criteria ensures assets deliver sustainable rental yields, capital appreciation, and long-term value preservation.

Investors who prioritize structured investment property analysis in Portugal are better positioned to navigate market cycles and capitalize on the country's economic and sectoral strengths. With expertise in sourcing, evaluating, and managing commercial property in Portugal, Roca Estate provides access to opportunities that align with both yield objectives and risk profiles, supporting informed decision-making and long-term portfolio growth.

ContactRoca Estate today to explore tailored investment strategies and secure your position in Portugal's most promising commercial real estate opportunities.